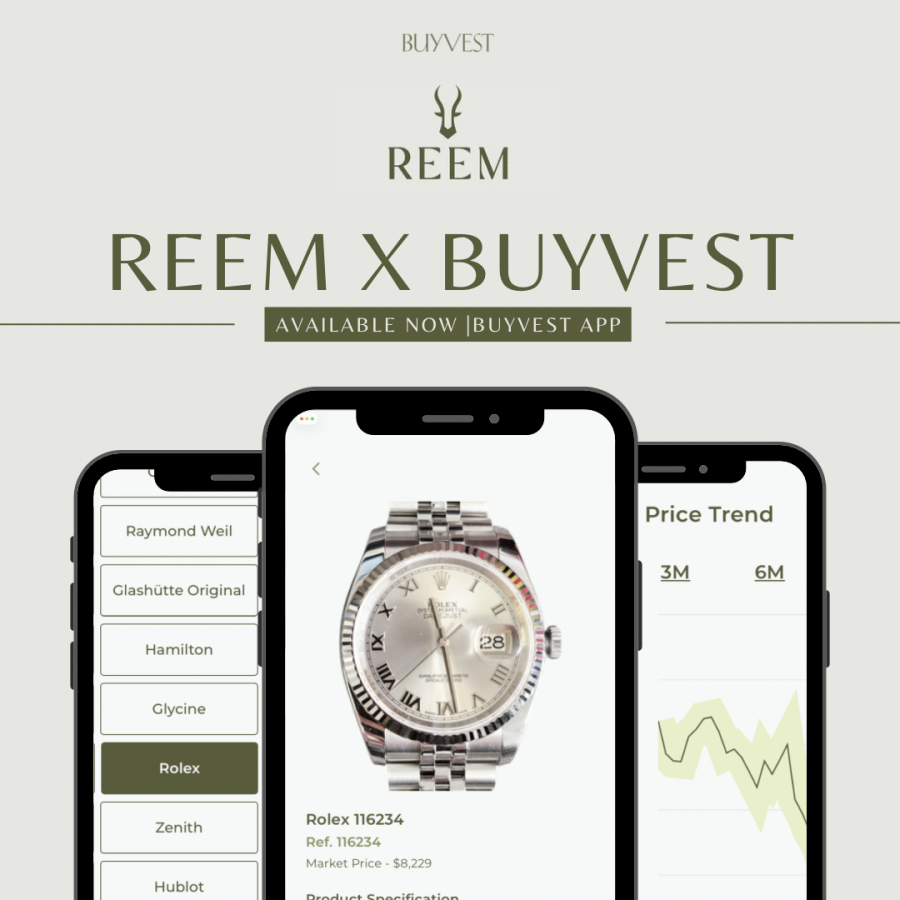

BUYVEST Launches REEM, the “Blue Book” Pricing Authority for Pre-loved Luxury Watches

Download the BUYVEST App for free access to current and historical pricing and data insights

With its cultural significance of grace and elegance in the region, the REEM brand is the latest update to the BUYVEST app, providing current and historical pricing for a catalog of over 25,000 luxury watches.

As the trusted resource for information on luxury assets, REEM is the regional authority for exclusive watch pricing, offering unmatched detail and accuracy. Utilizing advanced AI and highly reliable industry-recognized sources for its price aggregation, REEM is the go-to data and insights provider for pre-loved luxury assets. Featured details available on the BUYVEST app include:

Market Price

Pricing trends for luxury watches with visual graphs of value over time from the previous three months to five years.

Product Specifications:-

Number of jewels

Bezel and case materials

Crystal type and a wide range of horological design details

Dynamic bidding auctions for one-of-a-kind validated luxury assets.

Tracking the Price Evolution of Pre-loved Luxury Watches: A Strategic Investment Barometer

The pre-loved luxury watch market has emerged as far more than a niche collecting arena—it has become a sophisticated financial instrument that provides valuable insights for equity investors and market analysts. By tracking price movements in pre-owned timepieces from prestigious brands such as Rolex, Patek Philippe, and Audemars Piguet, investors can gain unique visibility into brand strength, consumer sentiment, and future growth trajectories that traditional financial metrics often fail to capture.

For equity investors focused on luxury goods companies, pre-owned watch prices serve as an exceptionally accurate barometer of brand desirability and market health. Unlike traditional retail sales data, which can be influenced by inventory management, promotional strategies, and seasonal fluctuations, secondary market prices reflect pure consumer demand dynamics in real-time.

When a brand's watches consistently trade above retail price in the pre-loved market, it signals genuine scarcity and desirability—indicators that often translate into sustained pricing power and revenue growth for the manufacturer. Conversely, secondary prices falling dramatically below retail typically indicate oversupply or weakening brand appeal, potentially foreshadowing challenges in future financial performance.

This relationship creates a forward-looking indicator system. Market strength for pre-loved luxury assets often precedes retail price increases by 12-18 months, giving astute investors early signals about which luxury brands are positioned for margin expansion and revenue growth. The data provides insights that are particularly valuable given the opacity that often surrounds luxury goods companies' production volumes and inventory levels.

Pre-Loved Luxury Asset Market Acceleration

Current market data for pre-owned luxury assets suggests that certain segments have been recovering from post-pandemic lows, and tariff-driven retail price increases could accelerate this trend. If consumers increasingly view this market as offering better value relative to tariff-inflated retail prices, it may be a driver of broader market acceleration across multiple price points and brands.

This increase likely benefits existing watch owners, dealers, and auction houses and creates new investment opportunities for pre-loved luxury asset trading. The shift strengthens the investment case for luxury watches as alternative assets, particularly for high-net-worth individuals seeking to diversify beyond traditional investments.

Investors should monitor secondary market price trends closely as leading indicators for brand health and pricing power. Brands showing secondary market strength despite retail price increases demonstrate genuine consumer loyalty and may be positioned for continued outperformance.

A New Paradigm for Luxury Investment Analysis

The intersection of rising retail prices, tariff uncertainty, and advantageous pre-loved luxury asset market dynamics has created a new paradigm for analyzing luxury watch investments. Rather than viewing previously owned assets as competition to retail sales, sophisticated investors now recognize them as valuable sources of market intelligence and potential profit acceleration.

By carefully monitoring price evolution in the pre-owned market, investors can position themselves ahead of trends that may significantly impact luxury brand valuations and create new opportunities for portfolio growth in an increasingly complex global trade environment.

0 COMMENTS